Chart Party: China Trends in Imported Nuclear Safety Equipment

The HAF604 certification is required for foreign firms to sell safety-grade equipment in China nuclear. Since it was first introduced in 2007, foreign companies have been required to pass through the complicated and arduous HAF604 application and review process before they can sign deals in China, or, in some cases, before they can even submit tenders.

One of the key requirements for HAF604 certification is that a foreign firm be able to secure proof of demand from two Chinese procuring parties. Also, the process for applying for HAF604 is so demanding of company time and resources that it's unlikely a foreign company would go through the hassle unless there is good reason to believe the market is receptive to their products or services. Thus, HAF604 certification trends YoY is a reasonable proxy for market demand/market opportunity for foreign firms in the Chinese nuclear space.

I pulled some data from Nicobar's HAF604 tracking spreadsheet to see if I could find some interesting trends for different products year-over-year. 2017 is excluded because we only have a partial year and I didn't want to throw off the data. Remember, each HAF604 certification is good for 5 years. A certification extension is counted as a new certificate (for example a company could be counted twice if it first obtained HAF604 in 2009 and re-certified in 2014)

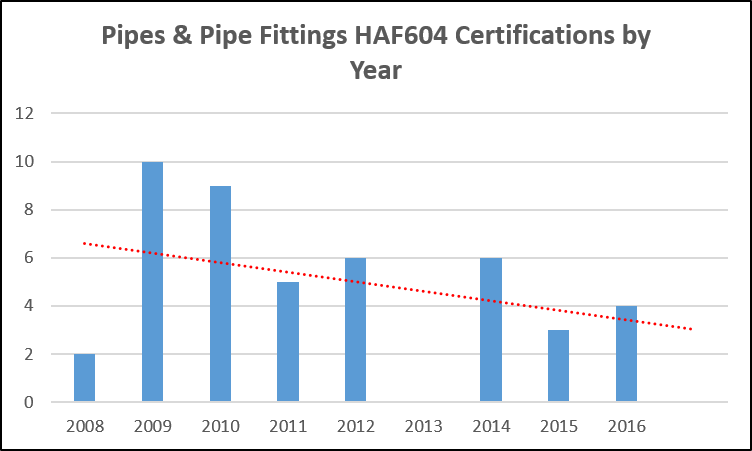

For Pipes and Pipe Fittings, the data show pretty much what I expected when I started this exercise - the opportunities for foreign firms declining over time as Chinese firms achieve localization of key safety equipment. I added a red trend-line to make the YoY decline more apparent. As Chinese firms achieve higher levels of mastery for safety class piping, it will get harder and harder for foreign firms to secure their proof of demand, or see credible market opportunities that would lead to pursuing a HAF604.

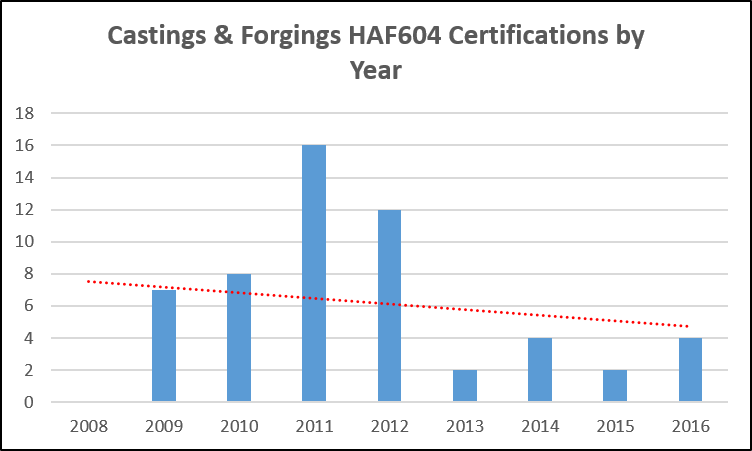

The situation for HAF604 certifications of nuclear grade Castings and Forgings is similar to piping, although the trend-line is less pronounced. Notice the big grouping of companies that got certified in 2011 - these certificates all expired in 2016 but only 4 certificates were issued in 2016. This indicates that the majority of those companies certified in 2011 chose to abandon the Chinese market by 2016.

Here's where things start to get interesting. As the chart above indicates, nuclear grade Sensors have been a point of continuing strength for foreign firms in the Chinese market. Even with the total blackout of new HAF604 certs in 2016, the trend-line of HAF604 certs from 2008-2016 actually has a slightly positive slope. I have a couple theories for why this might be so:

- Unlike major piping systems, sensors are more prone to failure and wearing out, needing replacement during scheduled outages and overhauls, creating more market opportunities across the plant's entire lifespan

- Sensor technology has improved since the first sensors were installed in Chinese reactors 25 years ago and there are more opportunities for companies with advanced, cutting edge technology

- The technology demands for manufacturing nuclear-grade sensors are relatively higher than those demanded for piping and Chinese manufacturers have been slower to master the technology

Here's the last one, and it's the component that consistently sticks out most among safety-class equipment HAF604s: Valves and Valve Components (excluding actuators). As the data show, foreign companies have actually been more successful YoY in securing HAF604 certifications for valves, with a positively sloping trend-line from 2008-2016. There are actually MORE valve companies holding HAF604 certificates today than in the past, even as Chinese companies continue to earn HAF601 for valves as well. I surmise this phenomenon is due to a combination of the following reasons:

- Like sensors, valves also are more prone to wear and tear and can be swapped out during outages and overhauls

- Like sensors, valve technology has continued to improve since the first Chinese plants were constructed and opportunities continue to exist for companies with advanced, cutting edge tech

- Like sensors, the technology requirements for safety class valves have been slower for Chinese plants to master, especially for Class 1

- Valve types can be highly plant-specific, so it's possible that the market has become available to more foreign players as China continues to diversity its reactor types

Conclusions and other Thoughts:

- Don't assume Chinese localization = less opportunities for foreign firms, at least not just yet. The market forces that shape China nuclear are more subtle and complex than that. Even as Chinese firms secure HAF601 certification for key safety class components, foreign firms may continue to receive HAF604s and win work for competitive products. Some companies like SPIC even cultivate multiple vendors for the same products, just so they can avoid monopolies and stimulate R&D.

- Some tech is more resistant to Chinese localization efforts than others. Valves and sensors seem to have more sticking power for foreign firms than piping, forgings and castings, for instance. Of course I realize that there are many types of valves and many types of sensors, and I have collapsed them all into one type of component for the purposes of this high-level analysis. A more granular analysis would be necessary to tease out the exact types of sensors or valves than foreign firms are still finding a market for in China.

- This data doesn't capture one important group of foreign manufacturers: those who established manufacturing operations in China either via joint venture or via a WFOE factory. Their joint venture would be a Chinese company and would need HAF601 certification, not HAF604. It would be interesting to examine what kind of success foreign firms have had by abandoning their HAF604 efforts and going after HAF601 as a local firm instead.